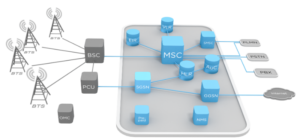

One of the lesser-known changes in 5G is the breakdown of the network boundary between the telecommunications network and the IT network.

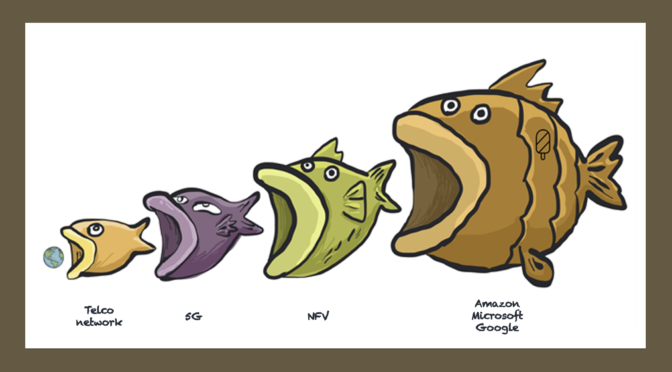

Beyond the physical radio towers, 5G networks are effectively Software-Defined Networks. This has serious implications for how network elements are implemented, and which companies stand to be the big winners and big losers from this new world. A key ingredient in this revolution is NFV.

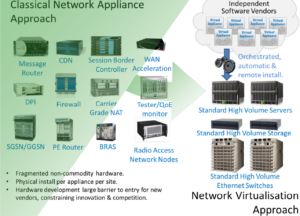

Network Function Virtualisation (NFV) is the idea of implementing networking elements in software, based on top of general purpose operating systems. NFV is not new, and is a fundamental principle in IT of how SDNs are implemented.

But what is new is the extension of the NFV concept into the heart of the mobile telecoms network, made possible by 5G. In the integrated world of 5G, even core network and access network elements, right down to low-level edge controllers, can be purely software-defined.

And if it is “just software”, then it can be put in the cloud.

Carrier Cloud

The cloud has slowly eaten many industries, and now it is the turn of telecoms. 5G and NFV have opened the possibility of implementing the entire telecoms world in the cloud, and the three leading cloud services providers – Amazon, Microsoft and Google – are all sensing a gold rush.

All three now have “carrier cloud” offerings, where they provide all the core 5G network functions on an As-A-Service basis, right down to edge elements.

Dish, soon to be the 4th largest mobile operator in the US, won’t have any 5G systems or infrastructure at all. Instead, it’s all in the cloud, on Amazon’s AWS. A few years ago, a progressive telco might decide to not own their own radio towers. Today, a progressive telco doesn’t own any network at all.

Google has similar initiatives in play, as part of its Google Global Mobile Edge Cloud offering.

But perhaps the most interesting carrier cloud story belongs to Microsoft. Microsoft was first to recognise the possibilities of carrier cloud, and has spent the past two years acquiring virtual 5G network element vendors. This has now led to the biggest carrier cloud project so far.

AT&T’s entire 5G core network, one of the world’s largest, will run on Microsoft Azure. That is revolutionary by itself, but the other half of the deal is equally significant. Microsoft will gain access to AT&T’s own network cloud software infrastructure layer, and will make this part of its offering. Called Azure for Operators, this “telco in a box” aims to offer cloud-based end-to-end 5G (and telco-grade SDN generally) to anyone who wants it, anywhere.

The implications are significant. For telecoms operators, the economics of building and owning a 5G network (or indeed any SDN, even SD-WAN) look less and less appealing.

What’s left is an operator that owns some radio spectrum and has some billing relationships – but no network. Every operator becomes an MVNO, while the real network sits on Azure, AWS or Google.

If you’re thinking this is all just an American peculiarity, think again. Other announced Azure for Operators customers include Deutsche Telekom, Telefonica and others.

Cloud computing ate IT departments (and their budgets) and moved the revenue to Silicon Valley. Likewise, Carrier Cloud may cause a vast shrinking of Telcos’ payrolls and expenditures as the action and the money flows to Big Tech. As a side-effect, telcos are likely to atrophy technical expertise as they move more into a utility marketing role.

What about customers?

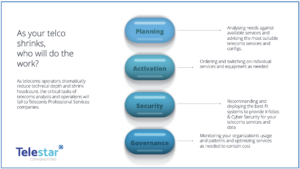

Perhaps the biggest implications are for enterprise customers: the businesses and governments who use the services of telecoms operators.

The old days of taking telecoms technical advice from the telecom operator vendor, or waiting for the operator to suggest new services and technologies, are over. As operators shrink down their engineering expertise pool, it is likely that business and government clients will need to look to specialist telecoms consultants and services companies for the advice and assistance they need.

Carrier cloud enables easy turning up of new services and endless flexibility, but this also runs the risk of putting more work on the business customers. Often the planning, set-up, activation, security and governance of telecoms services is more work, and more specialised work, than businesses are equipped for. It can cost just as much as the corporate telecom bill in hidden admin and internal labour, as well as being a business distraction. In the old world, they could rely on their telecoms operator to help them in these areas. In the new world, specialist telecoms management services providers will be relied upon to fill this gap.

| 5G | Fifth generation mobile telecommunications architecture |

| 2G/3G | Second and third generation mobile telecommunications architecture |

| AMF | Access and Mobility Function (5G) |

| AuC | Authentication Centre (GSM/2G/3G) |

| AWS | Amazon Web Services |

| BRAS | Broadband Remote Access Server |

| BSC | Base Station Controller |

| BSS | Billing Support Systems |

| CDN | Content Delivery Network |

| COTS | Common Off The Shelf Software |

| CU | Centralised Unit (5G) |

| DPI | Deep Packet inspection |

| DU | Distributed Unit (5G) |

| EIR | Equipment Identification Register |

| GGSN | Gateway GPRS Support Node (3G) |

| GPRS | General Packet Radio Service (2G) |

| GSM | Global System for Mobiles |

| HLR | Home Location Register (GSM/2G/3G) |

| IMS | IP Multimedia Subsystem |

| InfoSec | Information Security |

| IP | Internet Protocol |

| MEC | Multi-access Edge Computing (5G) |

| MSC | Mobile Switching Centre (GSM/2G/3G) |

| MVNO | Mobile Virtual Network Operator |

| NAT | Network Access Translation |

| NF | Network Function |

| NFV | Network Function Virtualisation |

| NFVI | Network Function Virtualisation Instance |

| NMS | Network Management System |

| NSSF | Network Slice Selection Function (5G) |

| O-RAN | Open Radio Access Network (5G) |

| OMC | Operation Maintenance Centre |

| OSS | Operational Support Systems |

| PBX | Public Branch eXchange |

| PCF | Policy Control Function (5G) |

| PCU | Packet Control Unit (3G) |

| PE Router | Provider Edge Router |

| PLMN | Public Land Mobile Network |

| PSTN | Public Switched Telephone Network |

| QoE | Quality of Experience |

| RAN | Radio Access Network (5G) |

| RU | Radio Unit (5G) |

| SD-WAN | Software Defined Wide Area Network |

| SDN | Software Defined Networking |

| SGSN | Serving GPRS Support Node (3G) |

| SMF | Session Management Function (5G) |

| SMSC | Shorrt Message Service Centre |

| UDM | Unified Data Management (5G) |

| UPF | User Plane Function (5G) |

| VLR | Visitor Location Register (GSM/2G/3G) |

| WAN | Wide Area Network |